Top Related Projects

AKShare is an elegant and simple financial data interface library for Python, built for human beings! 开源财经数据接口库

基于Python的开源量化交易平台开发框架

A extendable, replaceable Python algorithmic backtest && trading framework supporting multiple securities

QUANTAXIS 支持任务调度 分布式部署的 股票/期货/期权 数据/回测/模拟/交易/可视化/多账户 纯本地量化解决方案

Python wrapper for TA-Lib (http://ta-lib.org/).

Quick Overview

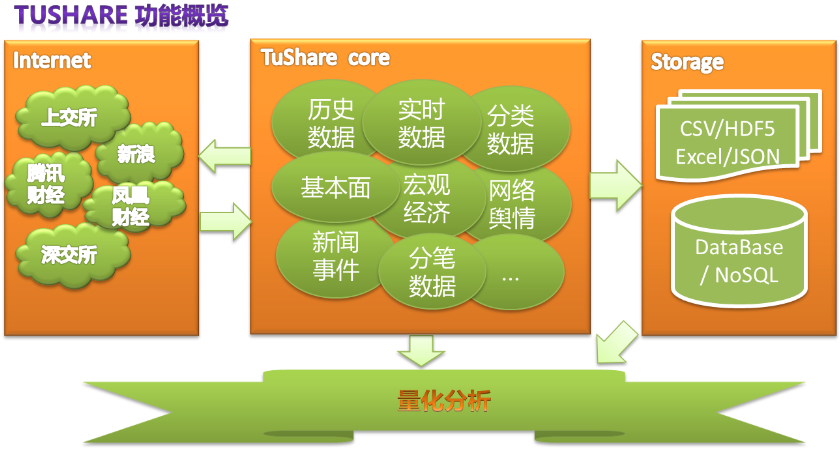

TuShare is an open-source Python library for fetching historical and real-time financial market data, primarily focused on Chinese markets. It provides easy access to stock quotes, financial statements, macroeconomic data, and more, making it a valuable tool for financial analysis and research in the Chinese market context.

Pros

- Comprehensive coverage of Chinese financial market data

- Easy-to-use API with Pandas DataFrame integration

- Regular updates and active community support

- Free access to basic data, with pro version available for advanced features

Cons

- Limited documentation in English, primarily Chinese-focused

- Some data sources may require a paid subscription

- Potential for API rate limiting or data access restrictions

- May not be as comprehensive for non-Chinese markets

Code Examples

Fetching daily stock data:

import tushare as ts

# Set your TuShare API token

ts.set_token('your_token_here')

# Initialize the pro API

pro = ts.pro_api()

# Get daily stock data for a specific stock

df = pro.daily(ts_code='000001.SZ', start_date='20220101', end_date='20221231')

print(df.head())

Getting company financial statements:

import tushare as ts

pro = ts.pro_api()

# Fetch income statement data

income_statement = pro.income(ts_code='000001.SZ', start_date='20220101', end_date='20221231')

print(income_statement.head())

Retrieving macroeconomic data:

import tushare as ts

pro = ts.pro_api()

# Get GDP data

gdp_data = pro.gdp(start_q='2022Q1', end_q='2022Q4')

print(gdp_data)

Getting Started

-

Install TuShare:

pip install tushare -

Sign up for a TuShare account and obtain an API token from the TuShare website.

-

Set up your API token in your Python script:

import tushare as ts ts.set_token('your_token_here') pro = ts.pro_api() -

Start fetching data using the various API functions available in the

proobject.

Competitor Comparisons

AKShare is an elegant and simple financial data interface library for Python, built for human beings! 开源财经数据接口库

Pros of akshare

- More comprehensive data coverage, including global markets and alternative data sources

- Faster data retrieval and processing capabilities

- More frequent updates and active community support

Cons of akshare

- Steeper learning curve due to more complex API structure

- Less stable API, with more frequent changes and updates

- Potentially higher resource consumption due to broader data coverage

Code comparison

akshare:

import akshare as ak

stock_zh_a_spot_df = ak.stock_zh_a_spot()

print(stock_zh_a_spot_df)

tushare:

import tushare as ts

df = ts.get_today_all()

print(df)

Both libraries provide similar functionality for retrieving stock data, but akshare offers more detailed options and a wider range of data sources. The akshare code example demonstrates retrieving real-time A-share stock data, while the tushare example fetches all stock data for the current day.

akshare's API tends to be more specific and granular, allowing for more precise data retrieval. In contrast, tushare's API is generally simpler and more straightforward, which can be beneficial for users with less complex requirements or those new to financial data analysis in Python.

基于Python的开源量化交易平台开发框架

Pros of vnpy

- More comprehensive trading platform with support for multiple asset classes

- Offers a complete trading system including risk management and backtesting

- Provides a modular architecture allowing for easy customization and extension

Cons of vnpy

- Steeper learning curve due to its complexity and extensive features

- Requires more system resources to run compared to tushare

- May be overkill for users only interested in data retrieval and analysis

Code Comparison

vnpy example (event-driven architecture):

from vnpy.event import EventEngine

from vnpy.trader.engine import MainEngine

from vnpy.trader.ui import MainWindow, create_qapp

def main():

qapp = create_qapp()

event_engine = EventEngine()

main_engine = MainEngine(event_engine)

main_window = MainWindow(main_engine, event_engine)

main_window.showMaximized()

qapp.exec_()

tushare example (data retrieval):

import tushare as ts

df = ts.get_hist_data('000001')

print(df.head())

Summary

vnpy is a full-featured trading platform suitable for professional traders and institutions, while tushare focuses primarily on financial data retrieval and analysis. vnpy offers more comprehensive functionality but requires more resources and has a steeper learning curve. tushare is simpler to use and more lightweight, making it ideal for researchers and analysts primarily interested in data access.

A extendable, replaceable Python algorithmic backtest && trading framework supporting multiple securities

Pros of rqalpha

- More comprehensive backtesting and simulation capabilities

- Supports multiple asset classes (stocks, futures, options)

- Provides a complete trading system framework

Cons of rqalpha

- Steeper learning curve due to its complexity

- Less focus on data retrieval compared to Tushare

- Requires more setup and configuration

Code Comparison

rqalpha:

from rqalpha.api import *

def init(context):

context.s1 = "000001.XSHE"

def handle_bar(context, bar_dict):

order_shares(context.s1, 100)

Tushare:

import tushare as ts

df = ts.get_k_data('000001', start='2019-01-01', end='2019-12-31')

print(df.head())

Summary

rqalpha is a more comprehensive trading system framework with advanced backtesting capabilities, while Tushare focuses primarily on financial data retrieval. rqalpha offers support for multiple asset classes and provides a complete trading ecosystem, but it comes with a steeper learning curve. Tushare, on the other hand, is simpler to use for data acquisition but lacks the advanced trading and backtesting features of rqalpha.

QUANTAXIS 支持任务调度 分布式部署的 股票/期货/期权 数据/回测/模拟/交易/可视化/多账户 纯本地量化解决方案

Pros of QUANTAXIS

- More comprehensive, offering a full-stack quantitative trading and investment solution

- Provides advanced features like backtesting, real-time monitoring, and risk management

- Supports multiple asset classes, including stocks, futures, and cryptocurrencies

Cons of QUANTAXIS

- Steeper learning curve due to its complexity and extensive features

- Less focused on data retrieval compared to Tushare

- May be overkill for users who only need basic financial data

Code Comparison

QUANTAXIS example:

import QUANTAXIS as QA

data = QA.QA_fetch_stock_day_adv('000001', '2019-01-01', '2019-12-31')

QA.QA_Risk.QA_backtest_risk_analysis(account)

Tushare example:

import tushare as ts

df = ts.get_hist_data('000001', start='2019-01-01', end='2019-12-31')

print(df.head())

QUANTAXIS offers more advanced functionality for quantitative analysis and backtesting, while Tushare focuses on simple and straightforward data retrieval. QUANTAXIS is better suited for complex trading strategies and risk management, whereas Tushare is ideal for basic financial data access and analysis.

Python wrapper for TA-Lib (http://ta-lib.org/).

Pros of ta-lib-python

- Extensive library of technical analysis functions

- Well-established and widely used in the financial industry

- Supports multiple programming languages beyond Python

Cons of ta-lib-python

- Requires separate C library installation, which can be complex

- Less focused on Chinese market-specific data and analysis

- May have a steeper learning curve for beginners

Code Comparison

ta-lib-python:

import talib

import numpy as np

close_prices = np.random.random(100)

sma = talib.SMA(close_prices, timeperiod=20)

rsi = talib.RSI(close_prices, timeperiod=14)

tushare:

import tushare as ts

df = ts.get_k_data('000001', start='2019-01-01', end='2019-12-31')

ma20 = df['close'].rolling(window=20).mean()

Key Differences

- tushare focuses on providing Chinese market data and simple analysis tools

- ta-lib-python offers a comprehensive set of technical indicators for any market

- tushare is more user-friendly for accessing and analyzing Chinese stock data

- ta-lib-python provides more advanced technical analysis capabilities

- tushare is easier to install and use for beginners, especially those focused on the Chinese market

Convert  designs to code with AI

designs to code with AI

Introducing Visual Copilot: A new AI model to turn Figma designs to high quality code using your components.

Try Visual CopilotREADME

TuShare

Tushare Proçå·²åå¸ï¼è¯·è®¿é®æ°çå®ç½äºè§£åæ¥è¯¢æ°æ®æ¥å£ï¼ https://tushare.pro

TuShareæ¯å®ç°å¯¹è¡ç¥¨/æè´§çéèæ°æ®ä»æ°æ®ééãæ¸ æ´å å·¥ å° **æ°æ®åå¨**è¿ç¨çå·¥å ·ï¼æ»¡è¶³éèéååæå¸åå¦ä¹ æ°æ®åæç人å¨æ°æ®è·åæ¹é¢çéæ±ï¼å®çç¹ç¹æ¯æ°æ®è¦çèå´å¹¿ï¼æ¥å£è°ç¨ç®å,ååºå¿«éã

欢è¿å ³æ³¨æ«æTuShareçå¾®ä¿¡å ¬ä¼å·âæå°å âï¼æ´å¤èµæºåä¿¡æ¯ä¸æ¨å享ãå¦å¤ï¼ç±äºtushareå®ç½å¨éæ°è®¾è®¡åå¼åï¼ææ°æ¥å£ç使ç¨ææ¡£é½ä¼å¨æå°å å ¬ä¼å·åå¸ï¼æ以ï¼è¯·æ«ç å ³æ³¨ï¼è°¢è°¢ï¼

QQ交æµç¾¤ï¼

- ä¸ç¾¤ï¼å·²æ»¡ï¼ï¼14934432

- äºç¾¤ï¼ä»è´¹é«çº§ç¨æ·ç¾¤ï¼å¯è·å¾æ´å¤æ¯æååä¸ååæ´»å¨ï¼ï¼658562506

- ä¸ç¾¤ï¼å è´¹ï¼ï¼665480579

- å群 (å è´¹) ï¼527416821

Dependencies

python 2.x/3.x

Installation

- æ¹å¼1ï¼pip install tushare

- æ¹å¼2ï¼python setup.py install

- æ¹å¼3ï¼è®¿é®https://pypi.python.org/pypi/tushare/ä¸è½½å®è£

Upgrade

pip install tushare --upgrade

Quick Start

Example 1. è·å个è¡åå²äº¤ææ°æ®ï¼å æ¬å线æ°æ®ï¼ï¼

import tushare as ts

ts.get_hist_data('600848') #ä¸æ¬¡æ§è·åå

¨é¨æ°æ®

å¦å¤ï¼åèget_k_dataå½æ°

ç»ææ¾ç¤ºï¼

æ¥æ ï¼å¼çä»·ï¼ æé«ä»·ï¼ æ¶çä»·ï¼ æä½ä»·ï¼ æ交éï¼ ä»·æ ¼åå¨ ï¼æ¶¨è·å¹ ï¼5æ¥åä»·ï¼10æ¥åä»·ï¼20æ¥åä»·ï¼5æ¥åéï¼10æ¥åéï¼20æ¥åéï¼æ¢æç

open high close low volume p_change ma5 \

date

2012-01-11 6.880 7.380 7.060 6.880 14129.96 2.62 7.060

2012-01-12 7.050 7.100 6.980 6.900 7895.19 -1.13 7.020

2012-01-13 6.950 7.000 6.700 6.690 6611.87 -4.01 6.913

2012-01-16 6.680 6.750 6.510 6.480 2941.63 -2.84 6.813

2012-01-17 6.660 6.880 6.860 6.460 8642.57 5.38 6.822

2012-01-18 7.000 7.300 6.890 6.880 13075.40 0.44 6.788

2012-01-19 6.690 6.950 6.890 6.680 6117.32 0.00 6.770

2012-01-20 6.870 7.080 7.010 6.870 6813.09 1.74 6.832

ma10 ma20 v_ma5 v_ma10 v_ma20 turnover

date

2012-01-11 7.060 7.060 14129.96 14129.96 14129.96 0.48

2012-01-12 7.020 7.020 11012.58 11012.58 11012.58 0.27

2012-01-13 6.913 6.913 9545.67 9545.67 9545.67 0.23

2012-01-16 6.813 6.813 7894.66 7894.66 7894.66 0.10

2012-01-17 6.822 6.822 8044.24 8044.24 8044.24 0.30

2012-01-18 6.833 6.833 7833.33 8882.77 8882.77 0.45

2012-01-19 6.841 6.841 7477.76 8487.71 8487.71 0.21

2012-01-20 6.863 6.863 7518.00 8278.38 8278.38 0.23

设å®åå²æ°æ®çæ¶é´ï¼

ts.get_hist_data('600848',start='2015-01-05',end='2015-01-09')

open high close low volume p_change ma5 ma10 \

date

2015-01-05 11.160 11.390 11.260 10.890 46383.57 1.26 11.156 11.212

2015-01-06 11.130 11.660 11.610 11.030 59199.93 3.11 11.182 11.155

2015-01-07 11.580 11.990 11.920 11.480 86681.38 2.67 11.366 11.251

2015-01-08 11.700 11.920 11.670 11.640 56845.71 -2.10 11.516 11.349

2015-01-09 11.680 11.710 11.230 11.190 44851.56 -3.77 11.538 11.363

ma20 v_ma5 v_ma10 v_ma20 turnover

date

2015-01-05 11.198 58648.75 68429.87 97141.81 1.59

2015-01-06 11.382 54854.38 63401.05 98686.98 2.03

2015-01-07 11.543 55049.74 61628.07 103010.58 2.97

2015-01-08 11.647 57268.99 61376.00 105823.50 1.95

2015-01-09 11.682 58792.43 60665.93 107924.27 1.54

å¤æåå²æ°æ® è·ååå²å¤ææ°æ®ï¼å为åå¤æååå¤ææ°æ®ï¼æ¥å£æä¾è¡ç¥¨ä¸å¸ä»¥æ¥ææåå²æ°æ®ï¼é»è®¤ä¸ºåå¤æãå¦æä¸è®¾å®å¼å§åç»ææ¥æï¼åè¿åè¿ä¸å¹´çå¤ææ°æ®ï¼ä»æ§è½ä¸èèï¼æ¨è设å®å¼å§æ¥æåç»ææ¥æï¼èä¸æ好ä¸è¦è¶ è¿ä¸å¹´ä»¥ä¸ï¼è·åå°æ°æ®åï¼è¯·åæ¶å¨æ¬å°åå¨ã

ts.get_h_data('002337') #åå¤æ

ts.get_h_data('002337',autype='hfq') #åå¤æ

ts.get_h_data('002337',autype=None) #ä¸å¤æ

ts.get_h_data('002337',start='2015-01-01',end='2015-03-16') #两个æ¥æä¹é´çåå¤ææ°æ®

Example 2. ä¸æ¬¡æ§è·åæè¿ä¸ä¸ªæ¥äº¤ææ¥ææè¡ç¥¨ç交ææ°æ®ï¼ç»ææ¾ç¤ºé度åå³äºç½éï¼

ts.get_today_all()

ç»ææ¾ç¤ºï¼

代ç ï¼å称ï¼æ¶¨è·å¹ ï¼ç°ä»·ï¼å¼çä»·ï¼æé«ä»·ï¼æä½ä»·ï¼ææ¥æ¶çä»·ï¼æ交éï¼æ¢æç

code name changepercent trade open high low settlement \

0 002738 ä¸ç¿èµæº 10.023 19.32 19.32 19.32 19.32 17.56

1 300410 æ£ä¸ç§æ 10.022 25.03 25.03 25.03 25.03 22.75

2 002736 å½ä¿¡è¯å¸ 10.013 16.37 16.37 16.37 16.37 14.88

3 300412 迦åç§æ 10.010 31.54 31.54 31.54 31.54 28.67

4 300411 éç¾è¡ä»½ 10.007 29.68 29.68 29.68 29.68 26.98

5 603636 åå¨è½¯ä»¶ 10.006 38.15 38.15 38.15 38.15 34.68

6 002664 ä¿¡è´¨çµæº 10.004 30.68 29.00 30.68 28.30 27.89

7 300367 ä¸æ¹ç½å 10.004 86.76 78.00 86.76 77.87 78.87

8 601299 ä¸å½å车 10.000 11.44 11.44 11.44 11.29 10.40

9 601880 大è¿æ¸¯ 10.000 5.72 5.34 5.72 5.22 5.20

10 000856 åä¸è£

å¤ 10.000 8.91 8.18 8.91 8.18 8.10

volume turnoverratio

0 375100 1.25033

1 85800 0.57200

2 1058925 0.08824

3 69400 0.51791

4 252220 1.26110

5 1374630 5.49852

6 6448748 9.32700

7 2025030 6.88669

8 433453523 4.28056

9 323469835 9.61735

10 25768152 19.51090

Example 3. è·ååå²åç¬æ°æ®

import tushare as ts

df = ts.get_tick_data('600848',date='2014-01-09')

df.head(10)

ç»ææ¾ç¤ºï¼

æ交æ¶é´ãæäº¤ä»·æ ¼ãä»·æ ¼åå¨ï¼æ交æãæ交éé¢(å )ï¼ä¹°åç±»å

Out[3]:

time price change volume amount type

0 15:00:00 6.05 -- 8 4840 åç

1 14:59:55 6.05 -- 50 30250 åç

2 14:59:35 6.05 -- 20 12100 åç

3 14:59:30 6.05 -0.01 165 99825 åç

4 14:59:20 6.06 0.01 4 2424 ä¹°ç

5 14:59:05 6.05 -0.01 2 1210 åç

6 14:58:55 6.06 -- 4 2424 ä¹°ç

7 14:58:45 6.06 -- 2 1212 ä¹°ç

8 14:58:35 6.06 0.01 2 1212 ä¹°ç

9 14:58:25 6.05 -0.01 20 12100 åç

10 14:58:05 6.06 -- 5 3030 ä¹°ç

Example 4. è·åå®æ¶äº¤ææ°æ®(Realtime Quotes Data)

df = ts.get_realtime_quotes('000581') #Single stock symbol

df[['code','name','price','bid','ask','volume','amount','time']]

ç»ææ¾ç¤ºï¼

å称ãå¼çä»·ãæ¨ä»·ãç°ä»·ãæé«ãæä½ãä¹°å ¥ä»·ãååºä»·ãæ交éãæ交éé¢...more in docs

code name price bid ask volume amount time

0 000581 å¨åé«ç§ 31.15 31.14 31.15 8183020 253494991.16 11:30:36

请æ±å¤ä¸ªè¡ç¥¨æ¹æ³ï¼ä¸æ¬¡æ好ä¸è¦è¶ è¿30个ï¼ï¼

ts.get_realtime_quotes(['600848','000980','000981']) #symbols from a list

ts.get_realtime_quotes(df['code'].tail(10)) #from a Series

æ´å¤ææ¡£

Change Logs

1.2.17 2018/11/24

- Proçå¢å æè´§æ°æ®

- Proçå¢å Aè¡å¨/ææ°æ®

- Proçå¢å éç¨è¡æ pro_baræ¥å£è¡ç¥¨/åºé/æè´§/æ°æ®è´§å¸è¡æ çæ¯æï¼åæ¶æ¯æè¡ç¥¨çå¤æè¡æ

1.2.15 2018/10/15

- å¢å éç¨è¡æ pro_baræ¥å£

- ä¼åset_tokenåè½

1.2.12 2018/08/10

- åå¸Proç第ä¸ç¨¿

- åå¸Proç½ç«ï¼https://tushare.pro

1.0.5 2017/11/12

- æ°å¢å¯è½¬åºæ°æ®

- å¢å é¿è¿æ¥å ³éå½æ°

- ä¿®å¤é¨åbug

1.0.2 2017/10/29

- æ°å¢baræ¥å£ï¼æ¯ææ´ç¨³å®çè¡ç¥¨ãETFãæè´§ææã港è¡ãä¸æ¦è¡çåç§

- æ°å¢tickæ¥å£ï¼æ¯æ以ä¸åç§çæ交æ°æ®

- æ°å¢æ²ªæ·±æ¸¯éæ¯æ¥èµéæµåæ°æ®

- ä¿®å¤äºé¨åbug

0.9.2 2017/09/13

- æ°å¢æ°æ®è´§å¸è¡æ æ°æ®æ¥å£,åæ¶æ¯æç«å¸ãokcoinãä¸å½æ¯ç¹å¸

- é¨åbugä¿®å¤

0.8.8 2017/08/29

- æ°å¢å红éè¡æ°æ®ï¼å å«åå²ï¼

- æ°å¢get_day_allæ¥å£

- æ°å¢BDIæ¥å£

0.8.0 2017/06/05

- æ°å¢æè´§è¡æ æ°æ®6个æ¥å£ï¼æè°¢debugoè´¡ç®ä»£ç

- ä¿®å¤é¨åbug

0.7.6 2017/05/16

- get_today_allæ¥å£æ°æ®è¡¥é½

- forecast_data macä¸ç¼ç é®é¢ä¿®å¤

0.7.0 2017/03/12

- get_today_allæ¥å£æé

- çæ¬ç´¯ç§¯æ´æ°

0.6.2 2016/12/03

- æ°å¢å大è¡ä¸åå大æµéè¡æ¥å£ top10_holders

- æ°å¢å ¨çå®æ¶ææ°å表æ¥å£ global_realtime

- ä¿®å¤é¨åbug

0.6.1 2016/11/22

- ä¿®æ£get_k_databug

- ä¿®æ£å®ç交æç»å½é®é¢

0.5.6 2016/11/06

- æ°å¢å ¨æ°è¡æ æ°æ®æ¥å£get_k_data(è¯·å ³æ³¨tushareå ¬ä¼å·âæå°å âåæ¥çåå²æç« ãå ¨æ°çå è´¹è¡æ æ°æ®æ¥å£ã)

- ä¿®å¤ç¨åºåææ¡£bug

0.5.1 2016/10/16

- æ°å¢å®ç交ææ¥å£

- ä¿®å¤bug

0.4.9 2016/03/26

- æ°å¢ç³ä¸è¡ä¸åç±»get_industry_classified(standard='sw')

- æ°å¢äº¤ææ¥åtrade_cal()

- ä¿®å¤bug

0.4.3 2015/12/24

- æ°å¢çµå½±ç¥¨æ¿æ°æ®

- ä¿®å¤é¨åbug

0.4.1 2015/11/27

- æ°å¢sina大åæ°æ®

- ä¿®æ¹å½æ¥åç¬bug

- æ·±å¸èèµèå¸æ°æ®ä¿®å¤

0.3.9 2015/10/13

- æ°å¢ææéå«æ³¢å¨çæ°æ®

- ä¿®å¤ææ°æ份åæéæ¥å£é®é¢

0.3.8 2015/09/19

- 沪深300æ份è¡åæéæ¥å£é®é¢ä¿®å¤

- å ¶å®bugçä¿®å¤

0.3.5 2015/07/27

- é¨å代ç ä¿®æ£

0.3.4 2015/06/15

-

æ°å¢âé¾èæ¦â模å

- æ¯æ¥é¾èæ¦å表

- 个è¡ä¸æ¦ç»è®¡

- è¥ä¸é¨ä¸æ¦ç»è®¡

- é¾èæ¦æºæå¸ä½è¿½è¸ª

- é¾èæ¦æºæå¸ä½æ交æç»

-

ä¿®æ¹get_h_dataæ°æ®ç±»å为float

-

ä¿®æ¹get_indexæ¥å£éæ¼çopenå

-

å并GitHubä¸æ交çbugä¿®å¤

0.2.8 2015/04/28

- æ°å¢å¤§çææ°å®æ¶è¡æ å表

- æ°å¢å¤§çææ°åå²è¡æ æ°æ®ï¼å ¨é¨ï¼

- æ°å¢ç»æ¢ä¸å¸å ¬å¸å表ï¼éå¸ï¼

- æ°å¢æåä¸å¸å ¬å¸å表

- ä¿®æ£èèµèå¸æç»æ æ¥æç缺é·

- ä¿®æ£get_h_dataé¨åbug

0.2.6

- æ°å¢æ²ªå¸èèµèå¸å表

- æ°å¢æ²ªå¸èèµèå¸æç»å表

- æ°å¢æ·±å¸èèµèå¸å表

- æ°å¢æ·±å¸èèµèå¸æç»å表

- ä¿®æ£å¤ææ°æ®æ°æ®æºåºç°nullé æå¼å¸¸é®é¢ï¼å¯¹å¤§çº¦300个è¡ç¥¨æå½±åï¼

0.2.5 2015/04/16

- å®æpython2.xåpython3.xå ¼å®¹æ§æ¯æ

- é¨åç®æ³ä¼åå代ç éæ

- æ°å¢ä¸è¯500æ份è¡

- æ°å¢å½æ¥åç¬äº¤ææç»

- ä¿®æ£åé é¢æ¡ï¼é«é转ï¼bug

0.2.3 2015/04/11

- æ°å¢âæ°æµªè¡å§âæ¶æ¯åç度

- æ°å¢æ°è¡ä¸å¸æ°æ®

- ä¿®æ£âåºæ¬é¢â模åä¸æ°æ®éå¤çé®é¢

- ä¿®æ£åå²æ°æ®ç¼ºå°ä¸åcolumnï¼æ°æ®æ¥æºé®é¢ï¼çbug

0.2.0 2015/03/17

- æ°å¢åå²å¤ææ°æ®æ¥å£

- æ°å¢å³æ¶æ»å¨æ°é»ãä¿¡æ¯å°é·æ°æ®

- æ°å¢æ²ªæ·±300ææ°æè¡ä»½åå¨ææéã

- æ°å¢ä¸è¯50ææ°æ份è¡

- ä¿®æ¹åå²è¡æ æ°æ®ç±»å为float

0.1.9 2015/02/06

- å¢å åç±»æ°æ®

- å¢å æ°æ®åå¨ç¤ºä¾

0.1.6 2015/01/27

- å¢å äºéç¹ææ°çåå²åå®æ¶è¡æ

- æ´æ°docs

0.1.5 2015/01/26

- å¢å åºæ¬é¢æ°æ®æ¥å£

- åå¸ä¸ç使ç¨æåï¼å¼éTuShare docsç½ç«

0.1.3 2015/01/13

- å¢å å®æ¶äº¤ææ°æ®çè·å

- Done for crawling Realtime Quotes data

0.1.1 2015/01/11

- å¢å tickæ°æ®çè·å

0.1.0 2014/12/01

- å建第ä¸ä¸ªçæ¬

- å®ç°ä¸ªè¡åå²æ°æ®çè·å

Top Related Projects

AKShare is an elegant and simple financial data interface library for Python, built for human beings! 开源财经数据接口库

基于Python的开源量化交易平台开发框架

A extendable, replaceable Python algorithmic backtest && trading framework supporting multiple securities

QUANTAXIS 支持任务调度 分布式部署的 股票/期货/期权 数据/回测/模拟/交易/可视化/多账户 纯本地量化解决方案

Python wrapper for TA-Lib (http://ta-lib.org/).

Convert  designs to code with AI

designs to code with AI

Introducing Visual Copilot: A new AI model to turn Figma designs to high quality code using your components.

Try Visual Copilot